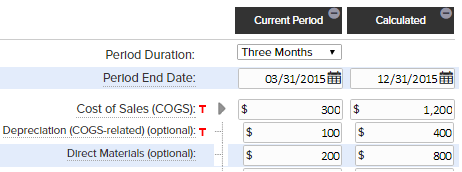

Income Statement

It will apply the annualization factor (e.g. If the period was 3 months, the factor is X4) to the sub-accounts and roll up the value to the main account.

For example the following 3 months Cost of Sales main account is calculated by applying the annualization factor to the sub-accounts (100 X 4 = 400, 200 X 4 = 800). The Cost of Sales is then calculated by summing up the resulting sub-accounts (400 + 800 = 1200).

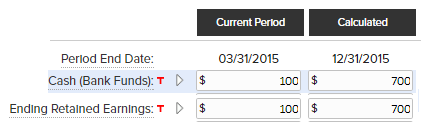

Balance Sheet

Other than Cash, Ending Retained Earnings, and Accumulated Depreciation, the rest of the balance sheet accounts will take values from the period that is being annualized.

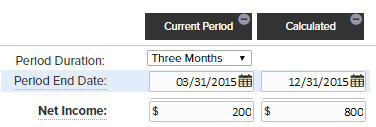

Cash & Ending Retained Earnings

For both accounts, we take the initial value from the base partial period + Difference between annualized and base partial period net income values.

Net Income Difference = 800 - 200 = 600

Calculated Cash = 100 + 600 = 700

Calculated Ending Retained Earnings = 100 + 600 = 700

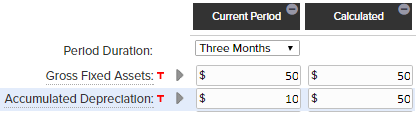

Accumulated Depreciation

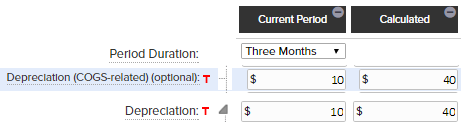

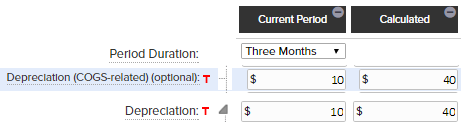

Accumulated Depreciation value in the annualized period will depend on base period Gross Fixed Assets value, changes in Depreciation (COGS-related) value, changes in Depreciation value, and base period Accumulated Depreciation value.

There are 2 scenarios:

If the Gross Fixed Assets value < The Sum of changes in Depreciation (COGS-related) value and changes in Depreciation value, then the annualized Accumulated Depreciation value will be the same as the base Gross Fixed Assets value.

Gross Fixed Assets = 50

changes in Depreciation (COGS-related) = 40 - 10 = 30

changes in Depreciation = 40 - 10 = 30

Since 50 < 30 + 30 , Accumulated Depreciation will take the same value as Gross Fixed Assets.

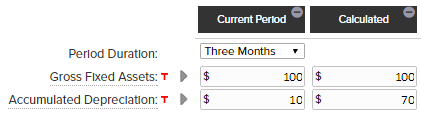

If the Gross Fixed Assets value > The Sum of changes in Depreciation (COGS-related) value and changes in Depreciation value, then the annualized Accumulated Depreciation value will be the sum of base period Accumulated Depreciation value, changes in Depreciation (COGS-related) value, and changes in Depreciation value.

Gross Fixed Assets = 100

base period Accumulated Depreciation = 10

changes in Depreciation (COGS-related) = 40 - 10 = 30

changes in Depreciation = 40 - 10 = 30

Since 100 > 30 + 30 , Accumulated Depreciation = 10 + 30 + 30